IRS Error Department (Mar 2021) Let’s Know About It -> Do you want to correct the errors in the file you gave to the IRS? Read the article and know the details of one of the IRS departments that can help you out.

IRS is the service of collecting revenue by the federal government of the United States. Today, we will be discussing the details of the IRS Error Department. Taxpayers have many errors in maintaining their files, and IRS finds the error and tries to correct it. But sometimes, these errors cannot be corrected, and people have to file an amended return.

Let’s see how this error department helps taxpayers to get their refunds. Moreover, we will also discuss the people’s response to the working of the department. So, stay connected to get well known with the department of the IRS.

What is the role of the IRS Error Department?

The department of IRS helps the taxpayers to avoid errors while making their files. It guides the taxpayers on how they can avoid errors and, if the errors are made, how one can correct them quickly. Amend return is the best way to mend your file. IRS department has a tool to know the conditions under which a taxpayer can amend the file.

In which cases you have to amend your file?

- The error department corrects the mathematical errors by itself. In case you have forgotten to attach some taxes and schedules, then this mistake is also bearable.

- IRS Error Department asks for the amendment of the file if you want to add up some different filing status and report some more income. One should change their file carefully as your changes will affect the federal return, and state tax will ultimately get affected.

How people react to the working of the department?

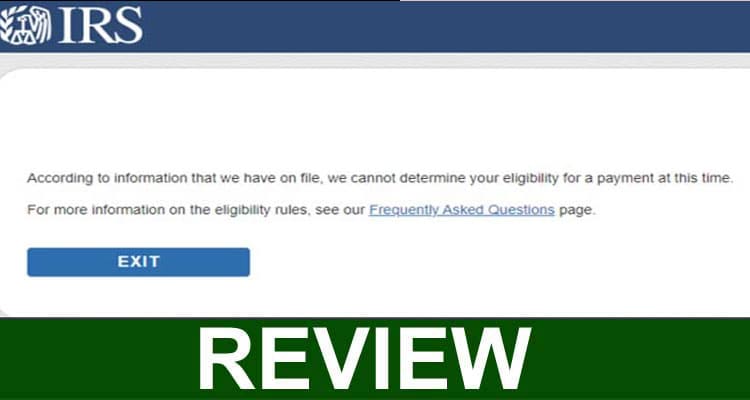

People have shared some comments online about the working of the department. As the error resolution department of IRS does not have enough members due to which the refunds are getting delayed. All the errors in the file are getting corrected, and it will take ten-fifteen days to get the returns.

People want information about their returns from IRS Error Department, but the responses are not given to them. All are waiting to receive their refunds.

The taxpayer’s advocate office is the place where issues related to the late refunds can be resolved.

Conclusion

The error department put down all efforts to resolve your minor errors. But taxpayer should make their files carefully to avoid mistakes. We have discussed the situations under which an amendment can be done.

Moreover, the contact number is also available on the internet to directly contact the error resolution department. Between 7 am to 7 pm, we can call to get an answer to our queries. IRS Error Department plays a crucial role in the IRS by resolving all the minor errors in the tax files so that people of the United States can get refunds.

What are your views about IRS? Please share some words about them in the comment section given below.